Event profiler¶

Inspired in QSTK (http://wiki.quantsoftware.org/index.php?title=QSTK_Tutorial_9), the eventprofiler module is a tool to analyze, statistically, how events affect future equity prices. The event profiler scans over historical data for a specified event and then calculates the impact of that event on the equity prices in the past and the future over a certain lookback period.

The goal of this tool is to help you quickly validate an idea, before moving forward with the backtesting process.

- class pyalgotrade.eventprofiler.Results(eventsDict, lookBack, lookForward)¶

Results from the profiler.

- getEventCount()¶

Returns the number of events occurred. Events that are on the boundary are skipped.

- class pyalgotrade.eventprofiler.Predicate¶

Base class for event identification. You should subclass this to implement the event identification logic.

- eventOccurred(instrument, bards)¶

Override (mandatory) to determine if an event took place in the last bar (bards[-1]).

Parameters: - instrument (string.) – Instrument identifier.

- bards (pyalgotrade.dataseries.bards.BarDataSeries.) – The BarDataSeries for the given instrument.

Return type: boolean.

- class pyalgotrade.eventprofiler.Profiler(predicate, lookBack, lookForward)¶

This class is responsible for scanning over historical data and analyzing returns before and after the events.

Parameters: - run(feed, useAdjustedCloseForReturns=True)¶

Runs the analysis using the bars supplied by the feed.

Parameters: - barFeed (pyalgotrade.barfeed.BarFeed.) – The bar feed to use to run the analysis.

- useAdjustedCloseForReturns (boolean.) – True if adjusted close values should be used to calculate returns.

- pyalgotrade.eventprofiler.plot(profilerResults)¶

Plots the result of the analysis.

Parameters: profilerResults (Results.) – The result of the analysis

Example¶

The following example is inspired on the ‘Buy-on-Gap Model’ from Ernie Chan’s book: ‘Algorithmic Trading: Winning Strategies and Their Rationale’:

- The idea is to select a stock near the market open whose returns from their previous day’s lows to today’s open are lower that one standard deviation. The standard deviation is computed using the daily close-to-close returns of the last 90 days. These are the stocks that “gapped down”.

- This is narrowed down by requiring the open price to be higher than the 20-day moving average of the closing price.

from pyalgotrade import eventprofiler

from pyalgotrade.technical import stats

from pyalgotrade.technical import roc

from pyalgotrade.technical import ma

from pyalgotrade.tools import yahoofinance

# Event inspired on an example from Ernie Chan's book:

# 'Algorithmic Trading: Winning Strategies and Their Rationale'

class BuyOnGap(eventprofiler.Predicate):

def __init__(self, feed):

stdDevPeriod = 90

smaPeriod = 20

self.__returns = {}

self.__stdDev = {}

self.__ma = {}

for instrument in feed.getRegisteredInstruments():

priceDS = feed[instrument].getAdjCloseDataSeries()

# Returns over the adjusted close values.

self.__returns[instrument] = roc.RateOfChange(priceDS, 1)

# StdDev over those returns.

self.__stdDev[instrument] = stats.StdDev(self.__returns[instrument], stdDevPeriod)

# MA over the adjusted close values.

self.__ma[instrument] = ma.SMA(priceDS, smaPeriod)

def __gappedDown(self, instrument, bards):

ret = False

if self.__stdDev[instrument][-1] != None:

prevBar = bards[-2]

currBar = bards[-1]

low2OpenRet = (currBar.getAdjOpen() - prevBar.getAdjLow()) / float(prevBar.getAdjLow())

if low2OpenRet < (self.__returns[instrument][-1] - self.__stdDev[instrument][-1]):

ret = True

return ret

def __aboveSMA(self, instrument, bards):

ret = False

if self.__ma[instrument][-1] != None and bards[-1].getAdjOpen() > self.__ma[instrument][-1]:

ret = True

return ret

def eventOccurred(self, instrument, bards):

ret = False

if self.__gappedDown(instrument, bards) and self.__aboveSMA(instrument, bards):

ret = True

return ret

def main(plot):

instruments = ["AA", "AES", "AIG"]

feed = yahoofinance.build_feed(instruments, 2008, 2009, ".")

predicate = BuyOnGap(feed)

eventProfiler = eventprofiler.Profiler(predicate, 5, 5)

eventProfiler.run(feed, True)

results = eventProfiler.getResults()

print "%d events found" % (results.getEventCount())

if plot:

eventprofiler.plot(results)

if __name__ == "__main__":

main(True)

The code is doing 4 things:

- Declaring a Predicate that implements the ‘Buy-on-Gap Model’ event identification.

- Loading bars for some stocks.

- Running the analysis.

- Plotting the results.

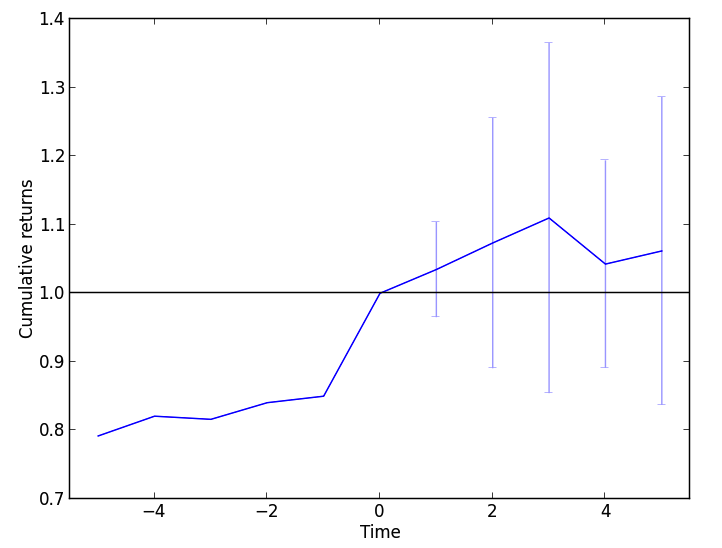

This is what the output should look like:

2013-09-20 23:30:45,340 yahoofinance [INFO] Creating data directory

2013-09-20 23:30:45,341 yahoofinance [INFO] Downloading AA 2008 to data/AA-2008-yahoofinance.csv

2013-09-20 23:30:46,092 yahoofinance [INFO] Downloading AES 2008 to data/AES-2008-yahoofinance.csv

2013-09-20 23:30:46,683 yahoofinance [INFO] Downloading AIG 2008 to data/AIG-2008-yahoofinance.csv

2013-09-20 23:30:47,260 yahoofinance [INFO] Downloading AA 2009 to data/AA-2009-yahoofinance.csv

2013-09-20 23:30:48,019 yahoofinance [INFO] Downloading AES 2009 to data/AES-2009-yahoofinance.csv

2013-09-20 23:30:48,761 yahoofinance [INFO] Downloading AIG 2009 to data/AIG-2009-yahoofinance.csv

14 events found

Note that Cummulative returns are normalized to the time of the event.