Ernie Chan’s Gold vs. Gold Miners¶

- This sample is based on:

from pyalgotrade import strategy

from pyalgotrade import dataseries

from pyalgotrade.dataseries import aligned

from pyalgotrade import plotter

from pyalgotrade.tools import yahoofinance

import numpy as np

import statsmodels.api as sm

def get_beta(values1, values2):

# http://statsmodels.sourceforge.net/stable/regression.html

model = sm.OLS(values1, values2)

results = model.fit()

return results.params[0]

class StatArbHelper:

def __init__(self, ds1, ds2, windowSize):

# We're going to use datetime aligned versions of the dataseries.

self.__ds1, self.__ds2 = aligned.datetime_aligned(ds1, ds2)

self.__windowSize = windowSize

self.__hedgeRatio = None

self.__spread = None

self.__spreadMean = None

self.__spreadStd = None

self.__zScore = None

def getSpread(self):

return self.__spread

def getSpreadMean(self):

return self.__spreadMean

def getSpreadStd(self):

return self.__spreadStd

def getZScore(self):

return self.__zScore

def getHedgeRatio(self):

return self.__hedgeRatio

def __updateHedgeRatio(self, values1, values2):

self.__hedgeRatio = get_beta(values1, values2)

def __updateSpreadMeanAndStd(self, values1, values2):

if self.__hedgeRatio != None:

spread = values1 - values2 * self.__hedgeRatio

self.__spreadMean = spread.mean()

self.__spreadStd = spread.std(ddof=1)

def __updateSpread(self):

if self.__hedgeRatio != None:

self.__spread = self.__ds1[-1] - self.__hedgeRatio * self.__ds2[-1]

def __updateZScore(self):

if self.__spread != None and self.__spreadMean != None and self.__spreadStd != None:

self.__zScore = (self.__spread - self.__spreadMean) / float(self.__spreadStd)

def update(self):

if len(self.__ds1) >= self.__windowSize:

values1 = np.array(self.__ds1[-1*self.__windowSize:])

values2 = np.array(self.__ds2[-1*self.__windowSize:])

self.__updateHedgeRatio(values1, values2)

self.__updateSpread()

self.__updateSpreadMeanAndStd(values1, values2)

self.__updateZScore()

class MyStrategy(strategy.BacktestingStrategy):

def __init__(self, feed, instrument1, instrument2, windowSize):

strategy.BacktestingStrategy.__init__(self, feed)

self.getBroker().setUseAdjustedValues(True)

self.__statArbHelper = StatArbHelper(feed[instrument1].getAdjCloseDataSeries(), feed[instrument2].getAdjCloseDataSeries(), windowSize)

self.__i1 = instrument1

self.__i2 = instrument2

# These are used only for plotting purposes.

self.__spread = dataseries.SequenceDataSeries()

self.__hedgeRatio = dataseries.SequenceDataSeries()

def getSpreadDS(self):

return self.__spread

def getHedgeRatioDS(self):

return self.__hedgeRatio

def __getOrderSize(self, bars, hedgeRatio):

cash = self.getBroker().getCash(False)

price1 = bars[self.__i1].getAdjClose()

price2 = bars[self.__i2].getAdjClose()

size1 = int(cash / (price1 + hedgeRatio * price2))

size2 = int(size1 * hedgeRatio)

return (size1, size2)

def buySpread(self, bars, hedgeRatio):

amount1, amount2 = self.__getOrderSize(bars, hedgeRatio)

self.order(self.__i1, amount1)

self.order(self.__i2, amount2 * -1)

def sellSpread(self, bars, hedgeRatio):

amount1, amount2 = self.__getOrderSize(bars, hedgeRatio)

self.order(self.__i1, amount1 * -1)

self.order(self.__i2, amount2)

def reducePosition(self, instrument):

currentPos = self.getBroker().getShares(instrument)

if currentPos > 0:

self.order(instrument, currentPos * -1)

elif currentPos < 0:

self.order(instrument, currentPos * -1)

def onBars(self, bars):

self.__statArbHelper.update()

# These is used only for plotting purposes.

self.__spread.appendWithDateTime(bars.getDateTime(), self.__statArbHelper.getSpread())

self.__hedgeRatio.appendWithDateTime(bars.getDateTime(), self.__statArbHelper.getHedgeRatio())

if bars.getBar(self.__i1) and bars.getBar(self.__i2):

hedgeRatio = self.__statArbHelper.getHedgeRatio()

zScore = self.__statArbHelper.getZScore()

if zScore != None:

currentPos = abs(self.getBroker().getShares(self.__i1)) + abs(self.getBroker().getShares(self.__i2))

if abs(zScore) <= 1 and currentPos != 0:

self.reducePosition(self.__i1)

self.reducePosition(self.__i2)

elif zScore <= -2 and currentPos == 0: # Buy spread when its value drops below 2 standard deviations.

self.buySpread(bars, hedgeRatio)

elif zScore >= 2 and currentPos == 0: # Short spread when its value rises above 2 standard deviations.

self.sellSpread(bars, hedgeRatio)

def main(plot):

instruments = ["gld", "gdx"]

windowSize = 50

# Download the bars.

feed = yahoofinance.build_feed(instruments, 2006, 2012, ".")

myStrategy = MyStrategy(feed, instruments[0], instruments[1], windowSize)

if plot:

plt = plotter.StrategyPlotter(myStrategy, False, False, True)

plt.getOrCreateSubplot("hedge").addDataSeries("Hedge Ratio", myStrategy.getHedgeRatioDS())

plt.getOrCreateSubplot("spread").addDataSeries("Spread", myStrategy.getSpreadDS())

myStrategy.run()

print "Result: %.2f" % myStrategy.getResult()

if plot:

plt.plot()

if __name__ == "__main__":

main(True)

this is what the output should look like:

2013-09-21 00:02:35,136 yahoofinance [INFO] Creating data directory

2013-09-21 00:02:35,136 yahoofinance [INFO] Downloading gld 2006 to data/gld-2006-yahoofinance.csv

2013-09-21 00:02:35,899 yahoofinance [INFO] Downloading gdx 2006 to data/gdx-2006-yahoofinance.csv

2013-09-21 00:02:36,637 yahoofinance [INFO] Downloading gld 2007 to data/gld-2007-yahoofinance.csv

2013-09-21 00:02:37,265 yahoofinance [INFO] Downloading gdx 2007 to data/gdx-2007-yahoofinance.csv

2013-09-21 00:02:37,881 yahoofinance [INFO] Downloading gld 2008 to data/gld-2008-yahoofinance.csv

2013-09-21 00:02:38,462 yahoofinance [INFO] Downloading gdx 2008 to data/gdx-2008-yahoofinance.csv

2013-09-21 00:02:39,243 yahoofinance [INFO] Downloading gld 2009 to data/gld-2009-yahoofinance.csv

2013-09-21 00:02:39,996 yahoofinance [INFO] Downloading gdx 2009 to data/gdx-2009-yahoofinance.csv

2013-09-21 00:02:40,577 yahoofinance [INFO] Downloading gld 2010 to data/gld-2010-yahoofinance.csv

2013-09-21 00:02:42,630 yahoofinance [INFO] Downloading gdx 2010 to data/gdx-2010-yahoofinance.csv

2013-09-21 00:02:43,397 yahoofinance [INFO] Downloading gld 2011 to data/gld-2011-yahoofinance.csv

2013-09-21 00:02:44,153 yahoofinance [INFO] Downloading gdx 2011 to data/gdx-2011-yahoofinance.csv

2013-09-21 00:02:44,901 yahoofinance [INFO] Downloading gld 2012 to data/gld-2012-yahoofinance.csv

2013-09-21 00:02:45,965 yahoofinance [INFO] Downloading gdx 2012 to data/gdx-2012-yahoofinance.csv

Result: 1241843.95

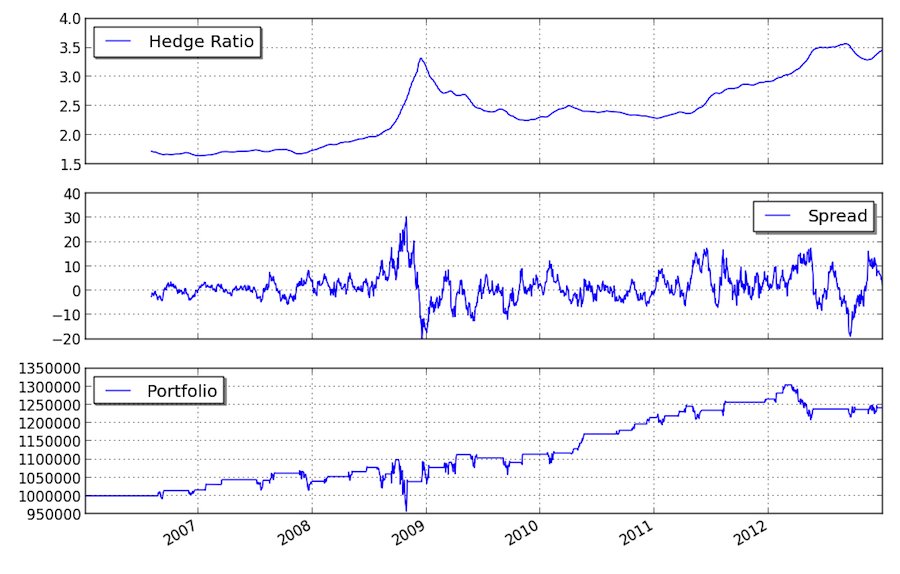

and this is what the plot should look like:

you can get better returns by tunning the window size as well as the entry and exit values for the z-score.