RSI2¶

This example is based on a strategy known as RSI2 (http://stockcharts.com/school/doku.php?id=chart_school:trading_strategies:rsi2) which requires the following parameters:

- An SMA period for trend identification. We’ll call this entrySMA.

- A smaller SMA period for the exit point. We’ll call this exitSMA.

- An RSI period for entering both short/long positions. We’ll call this rsiPeriod.

- An RSI oversold threshold for long position entry. We’ll call this overSoldThreshold.

- An RSI overbought threshold for short position entry. We’ll call this overBoughtThreshold.

Save this code as rsi2.py:

from pyalgotrade import strategy

from pyalgotrade.technical import ma

from pyalgotrade.technical import rsi

from pyalgotrade.technical import cross

class RSI2(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, entrySMA, exitSMA, rsiPeriod, overBoughtThreshold, overSoldThreshold):

strategy.BacktestingStrategy.__init__(self, feed)

self.__instrument = instrument

# We'll use adjusted close values, if available, instead of regular close values.

if feed.barsHaveAdjClose():

self.setUseAdjustedValues(True)

self.__priceDS = feed[instrument].getPriceDataSeries()

self.__entrySMA = ma.SMA(self.__priceDS, entrySMA)

self.__exitSMA = ma.SMA(self.__priceDS, exitSMA)

self.__rsi = rsi.RSI(self.__priceDS, rsiPeriod)

self.__overBoughtThreshold = overBoughtThreshold

self.__overSoldThreshold = overSoldThreshold

self.__longPos = None

self.__shortPos = None

def getEntrySMA(self):

return self.__entrySMA

def getExitSMA(self):

return self.__exitSMA

def getRSI(self):

return self.__rsi

def onEnterCanceled(self, position):

if self.__longPos == position:

self.__longPos = None

elif self.__shortPos == position:

self.__shortPos = None

else:

assert(False)

def onExitOk(self, position):

if self.__longPos == position:

self.__longPos = None

elif self.__shortPos == position:

self.__shortPos = None

else:

assert(False)

def onExitCanceled(self, position):

# If the exit was canceled, re-submit it.

position.exitMarket()

def onBars(self, bars):

# Wait for enough bars to be available to calculate SMA and RSI.

if self.__exitSMA[-1] is None or self.__entrySMA[-1] is None or self.__rsi[-1] is None:

return

bar = bars[self.__instrument]

if self.__longPos is not None:

if self.exitLongSignal():

self.__longPos.exitMarket()

elif self.__shortPos is not None:

if self.exitShortSignal():

self.__shortPos.exitMarket()

else:

if self.enterLongSignal(bar):

shares = int(self.getBroker().getCash() * 0.9 / bars[self.__instrument].getPrice())

self.__longPos = self.enterLong(self.__instrument, shares, True)

elif self.enterShortSignal(bar):

shares = int(self.getBroker().getCash() * 0.9 / bars[self.__instrument].getPrice())

self.__shortPos = self.enterShort(self.__instrument, shares, True)

def enterLongSignal(self, bar):

return bar.getPrice() > self.__entrySMA[-1] and self.__rsi[-1] <= self.__overSoldThreshold

def exitLongSignal(self):

return cross.cross_above(self.__priceDS, self.__exitSMA)

def enterShortSignal(self, bar):

return bar.getPrice() < self.__entrySMA[-1] and self.__rsi[-1] >= self.__overBoughtThreshold

def exitShortSignal(self):

return cross.cross_below(self.__priceDS, self.__exitSMA)

and use the following code to execute the strategy:

import rsi2

from pyalgotrade import plotter

from pyalgotrade.tools import yahoofinance

from pyalgotrade.stratanalyzer import sharpe

def main(plot):

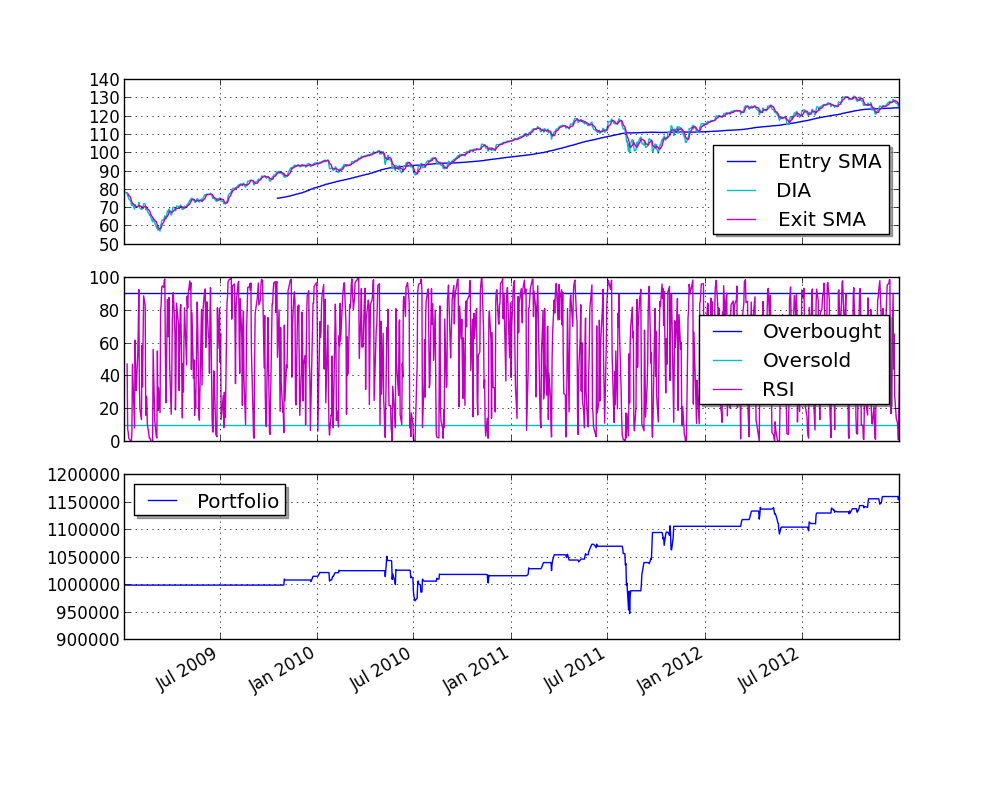

instrument = "DIA"

entrySMA = 200

exitSMA = 5

rsiPeriod = 2

overBoughtThreshold = 90

overSoldThreshold = 10

# Download the bars.

feed = yahoofinance.build_feed([instrument], 2009, 2012, ".")

strat = rsi2.RSI2(feed, instrument, entrySMA, exitSMA, rsiPeriod, overBoughtThreshold, overSoldThreshold)

sharpeRatioAnalyzer = sharpe.SharpeRatio()

strat.attachAnalyzer(sharpeRatioAnalyzer)

if plot:

plt = plotter.StrategyPlotter(strat, True, False, True)

plt.getInstrumentSubplot(instrument).addDataSeries("Entry SMA", strat.getEntrySMA())

plt.getInstrumentSubplot(instrument).addDataSeries("Exit SMA", strat.getExitSMA())

plt.getOrCreateSubplot("rsi").addDataSeries("RSI", strat.getRSI())

plt.getOrCreateSubplot("rsi").addLine("Overbought", overBoughtThreshold)

plt.getOrCreateSubplot("rsi").addLine("Oversold", overSoldThreshold)

strat.run()

print "Sharpe ratio: %.2f" % sharpeRatioAnalyzer.getSharpeRatio(0.05)

if plot:

plt.plot()

if __name__ == "__main__":

main(True)

This is what the output should look like:

2014-05-03 13:49:35,354 yahoofinance [INFO] Downloading DIA 2009 to ./DIA-2009-yahoofinance.csv

2014-05-03 13:49:36,388 yahoofinance [INFO] Downloading DIA 2010 to ./DIA-2010-yahoofinance.csv

2014-05-03 13:49:36,900 yahoofinance [INFO] Downloading DIA 2011 to ./DIA-2011-yahoofinance.csv

2014-05-03 13:49:37,457 yahoofinance [INFO] Downloading DIA 2012 to ./DIA-2012-yahoofinance.csv

Sharpe ratio: -0.11

and this is what the plot should look like:

You can get better returns by tunning the different parameters.