SMA Crossover¶

Save this code as sma_crossover.py:

from pyalgotrade import strategy

from pyalgotrade.technical import ma

from pyalgotrade.technical import cross

class SMACrossOver(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, smaPeriod):

strategy.BacktestingStrategy.__init__(self, feed)

self.__instrument = instrument

self.__position = None

# We'll use adjusted close values instead of regular close values.

self.setUseAdjustedValues(True)

self.__prices = feed[instrument].getPriceDataSeries()

self.__sma = ma.SMA(self.__prices, smaPeriod)

def getSMA(self):

return self.__sma

def onEnterCanceled(self, position):

self.__position = None

def onExitOk(self, position):

self.__position = None

def onExitCanceled(self, position):

# If the exit was canceled, re-submit it.

self.__position.exitMarket()

def onBars(self, bars):

# If a position was not opened, check if we should enter a long position.

if self.__position is None:

if cross.cross_above(self.__prices, self.__sma) > 0:

shares = int(self.getBroker().getCash() * 0.9 / bars[self.__instrument].getPrice())

# Enter a buy market order. The order is good till canceled.

self.__position = self.enterLong(self.__instrument, shares, True)

# Check if we have to exit the position.

elif not self.__position.exitActive() and cross.cross_below(self.__prices, self.__sma) > 0:

self.__position.exitMarket()

and use the following code to execute the strategy:

import sma_crossover

from pyalgotrade import plotter

from pyalgotrade.tools import yahoofinance

from pyalgotrade.stratanalyzer import sharpe

def main(plot):

instrument = "aapl"

smaPeriod = 163

# Download the bars.

feed = yahoofinance.build_feed([instrument], 2011, 2012, ".")

strat = sma_crossover.SMACrossOver(feed, instrument, smaPeriod)

sharpeRatioAnalyzer = sharpe.SharpeRatio()

strat.attachAnalyzer(sharpeRatioAnalyzer)

if plot:

plt = plotter.StrategyPlotter(strat, True, False, True)

plt.getInstrumentSubplot(instrument).addDataSeries("sma", strat.getSMA())

strat.run()

print "Sharpe ratio: %.2f" % sharpeRatioAnalyzer.getSharpeRatio(0.05)

if plot:

plt.plot()

if __name__ == "__main__":

main(True)

This is what the output should look like:

2013-09-21 00:01:23,813 yahoofinance [INFO] Creating data directory

2013-09-21 00:01:23,814 yahoofinance [INFO] Downloading aapl 2011 to data/aapl-2011-yahoofinance.csv

2013-09-21 00:01:25,275 yahoofinance [INFO] Downloading aapl 2012 to data/aapl-2012-yahoofinance.csv

Sharpe ratio: 1.12

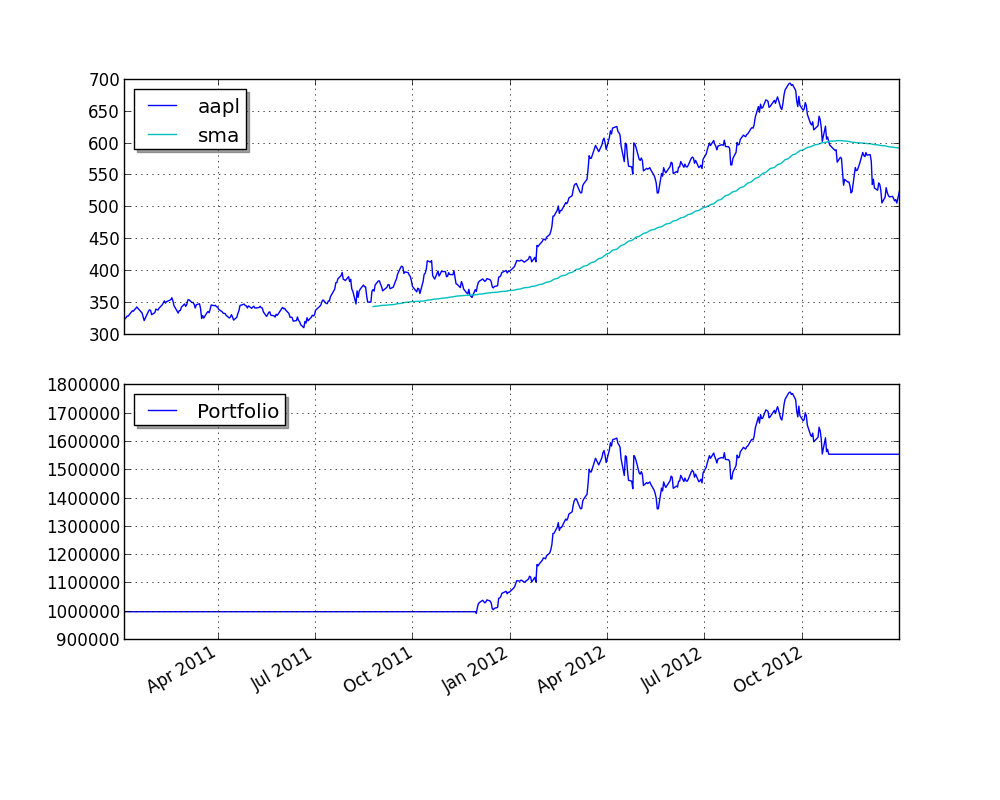

and this is what the plot should look like:

You can get better returns by tunning the sma period.