Bitcoin Charts example¶

Although it is absolutely possible to backtest a strategy with tick data as supplied by http://www.bitcoincharts.com/about/markets-api/ using pyalgotrade.bitcoincharts.barfeed.CSVTradeFeed, you may want to to backtest using summarized bars at a different frequency to make backtesting faster.

As of 12-Aug-2014, http://api.bitcoincharts.com/v1/csv/bitstampUSD.csv.gz has 4588830 events so we’ll transform a portion of it into 30 minute bars for backtesting purposes with the following script:

from pyalgotrade.bitcoincharts import barfeed

from pyalgotrade.tools import resample

from pyalgotrade import bar

import datetime

def main():

barFeed = barfeed.CSVTradeFeed()

barFeed.addBarsFromCSV("bitstampUSD.csv", fromDateTime=datetime.datetime(2014, 1, 1))

resample.resample_to_csv(barFeed, bar.Frequency.MINUTE*30, "30min-bitstampUSD.csv")

if __name__ == "__main__":

main()

It will take some time to execute, so be patient. The resampled file should look like this:

Date Time,Open,High,Low,Close,Volume,Adj Close

2014-01-01 00:00:00,732.0,738.25,729.01,734.81,266.17955488,

2014-01-01 00:30:00,734.81,739.9,734.47,739.02,308.96802502,

2014-01-01 01:00:00,739.02,739.97,737.65,738.11,65.66924473,

2014-01-01 01:30:00,738.0,742.0,737.65,741.89,710.27165024,

2014-01-01 02:00:00,741.89,757.99,741.89,752.23,1085.13335011,

2014-01-01 02:30:00,752.23,755.0,747.0,747.2,272.03949342,

2014-01-01 04:00:00,744.98,748.02,744.98,747.19,104.65989075,

.

.

We can now take advantage of pyalgotrade.barfeed.csvfeed.GenericBarFeed to load the resampled file and backtest a Bitcoin strategy. We’ll be using a VWAP momentum strategy for illustration purposes:

from pyalgotrade import bar

from pyalgotrade import strategy

from pyalgotrade import plotter

from pyalgotrade.technical import vwap

from pyalgotrade.barfeed import csvfeed

from pyalgotrade.bitstamp import broker

from pyalgotrade import broker as basebroker

class VWAPMomentum(strategy.BacktestingStrategy):

MIN_TRADE = 5

def __init__(self, feed, brk, instrument, vwapWindowSize, buyThreshold, sellThreshold):

strategy.BacktestingStrategy.__init__(self, feed, brk)

self.__instrument = instrument

self.__vwap = vwap.VWAP(feed[instrument], vwapWindowSize)

self.__buyThreshold = buyThreshold

self.__sellThreshold = sellThreshold

def _getActiveOrders(self):

orders = self.getBroker().getActiveOrders()

buy = filter(lambda o: o.isBuy(), orders)

sell = filter(lambda o: o.isSell(), orders)

return buy, sell

def _cancelOrders(self, orders):

brk = self.getBroker()

for o in orders:

self.info("Canceling order %s" % (o.getId()))

brk.cancelOrder(o)

def _buySignal(self, price):

buyOrders, sellOrders = self._getActiveOrders()

self._cancelOrders(sellOrders)

brk = self.getBroker()

cashAvail = brk.getCash() * 0.98

size = round(cashAvail / price, 3)

if len(buyOrders) == 0 and price*size > VWAPMomentum.MIN_TRADE:

self.info("Buy %s at %s" % (size, price))

try:

self.limitOrder(self.__instrument, price, size)

except Exception, e:

self.error("Failed to buy: %s" % (e))

def _sellSignal(self, price):

buyOrders, sellOrders = self._getActiveOrders()

self._cancelOrders(buyOrders)

brk = self.getBroker()

shares = brk.getShares(self.__instrument)

if len(sellOrders) == 0 and shares > 0:

self.info("Sell %s at %s" % (shares, price))

self.limitOrder(self.__instrument, price, shares*-1)

def getVWAP(self):

return self.__vwap

def onBars(self, bars):

vwap = self.__vwap[-1]

if vwap is None:

return

price = bars[self.__instrument].getClose()

if price > vwap * (1 + self.__buyThreshold):

self._buySignal(price)

elif price < vwap * (1 - self.__sellThreshold):

self._sellSignal(price)

def onOrderUpdated(self, order):

if order.isBuy():

orderType = "Buy"

else:

orderType = "Sell"

self.info("%s order %d updated - Status: %s - %s" % (

orderType,

order.getId(),

basebroker.Order.State.toString(order.getState()),

order.getExecutionInfo(),

))

def main(plot):

instrument = "BTC"

initialCash = 1000

vwapWindowSize = 100

buyThreshold = 0.02

sellThreshold = 0.01

barFeed = csvfeed.GenericBarFeed(bar.Frequency.MINUTE*30)

barFeed.addBarsFromCSV(instrument, "30min-bitstampUSD.csv")

brk = broker.BacktestingBroker(initialCash, barFeed)

strat = VWAPMomentum(barFeed, brk, instrument, vwapWindowSize, buyThreshold, sellThreshold)

if plot:

plt = plotter.StrategyPlotter(strat)

plt.getInstrumentSubplot(instrument).addDataSeries("VWAP", strat.getVWAP())

strat.run()

if plot:

plt.plot()

if __name__ == "__main__":

main(True)

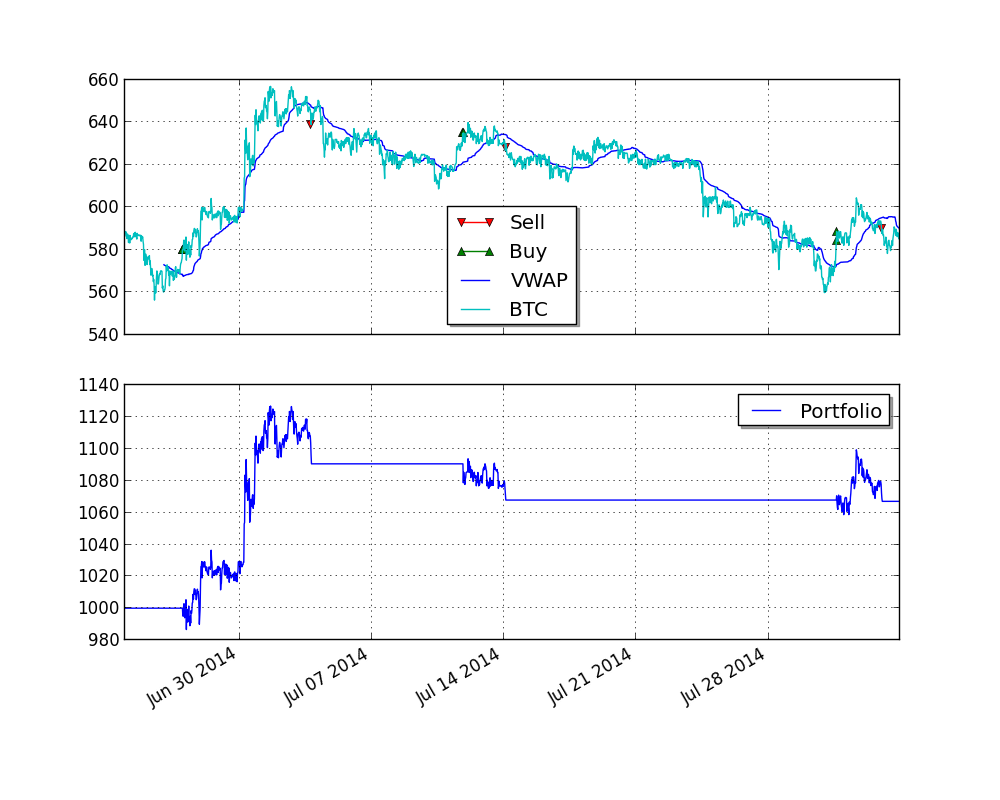

This is what the plot looks like: