Bollinger Bands¶

- This example is based on:

from pyalgotrade import strategy

from pyalgotrade import plotter

from pyalgotrade.tools import yahoofinance

from pyalgotrade.technical import bollinger

from pyalgotrade.stratanalyzer import sharpe

class BBands(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, bBandsPeriod):

super(BBands, self).__init__(feed)

self.__instrument = instrument

self.__bbands = bollinger.BollingerBands(feed[instrument].getCloseDataSeries(), bBandsPeriod, 2)

def getBollingerBands(self):

return self.__bbands

def onBars(self, bars):

lower = self.__bbands.getLowerBand()[-1]

upper = self.__bbands.getUpperBand()[-1]

if lower is None:

return

shares = self.getBroker().getShares(self.__instrument)

bar = bars[self.__instrument]

if shares == 0 and bar.getClose() < lower:

sharesToBuy = int(self.getBroker().getCash(False) / bar.getClose())

self.marketOrder(self.__instrument, sharesToBuy)

elif shares > 0 and bar.getClose() > upper:

self.marketOrder(self.__instrument, -1*shares)

def main(plot):

instrument = "yhoo"

bBandsPeriod = 40

# Download the bars.

feed = yahoofinance.build_feed([instrument], 2011, 2012, ".")

strat = BBands(feed, instrument, bBandsPeriod)

sharpeRatioAnalyzer = sharpe.SharpeRatio()

strat.attachAnalyzer(sharpeRatioAnalyzer)

if plot:

plt = plotter.StrategyPlotter(strat, True, True, True)

plt.getInstrumentSubplot(instrument).addDataSeries("upper", strat.getBollingerBands().getUpperBand())

plt.getInstrumentSubplot(instrument).addDataSeries("middle", strat.getBollingerBands().getMiddleBand())

plt.getInstrumentSubplot(instrument).addDataSeries("lower", strat.getBollingerBands().getLowerBand())

strat.run()

print "Sharpe ratio: %.2f" % sharpeRatioAnalyzer.getSharpeRatio(0.05)

if plot:

plt.plot()

if __name__ == "__main__":

main(True)

this is what the output should look like:

2013-09-21 00:06:07,740 yahoofinance [INFO] Creating data directory

2013-09-21 00:06:07,741 yahoofinance [INFO] Downloading yhoo 2011 to data/yhoo-2011-yahoofinance.csv

2013-09-21 00:06:09,621 yahoofinance [INFO] Downloading yhoo 2012 to data/yhoo-2012-yahoofinance.csv

Sharpe ratio: 0.71

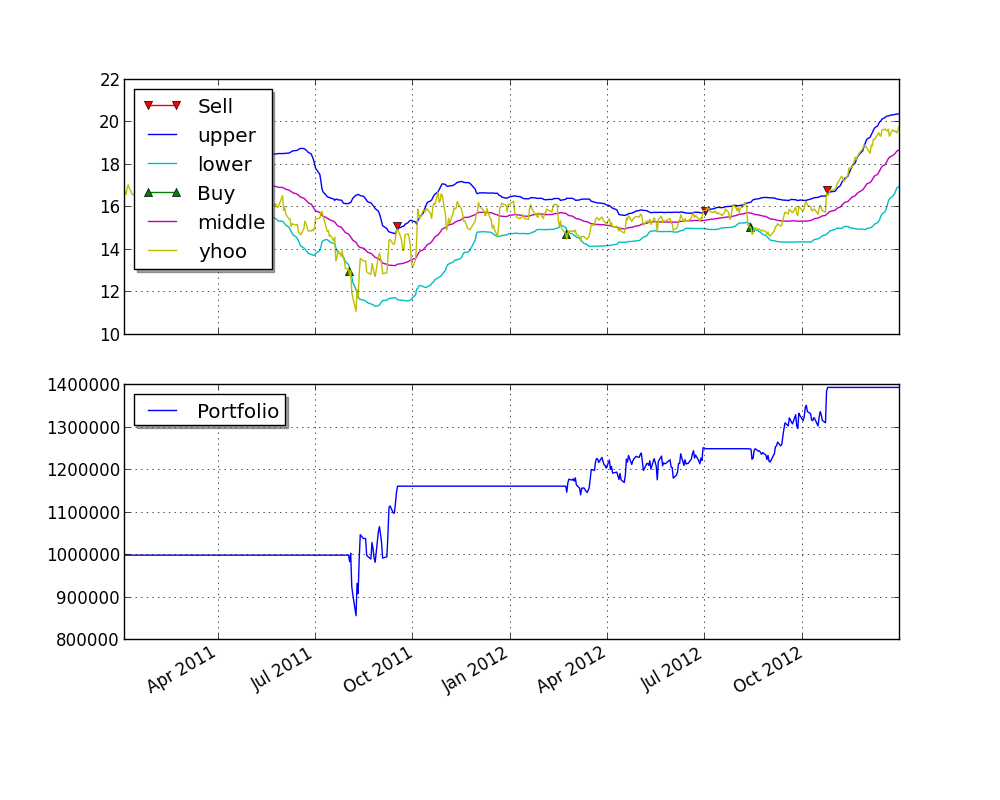

and this is what the plot should look like:

You can get better returns by tunning the Bollinger Bands period as well as the entry and exit points.