Ernie Chan’s Gold vs. Gold Miners¶

- This example is based on:

from pyalgotrade import strategy

from pyalgotrade import dataseries

from pyalgotrade.dataseries import aligned

from pyalgotrade import plotter

from pyalgotrade.tools import yahoofinance

from pyalgotrade.stratanalyzer import sharpe

import numpy as np

import statsmodels.api as sm

def get_beta(values1, values2):

# http://statsmodels.sourceforge.net/stable/regression.html

model = sm.OLS(values1, values2)

results = model.fit()

return results.params[0]

class StatArbHelper:

def __init__(self, ds1, ds2, windowSize):

# We're going to use datetime aligned versions of the dataseries.

self.__ds1, self.__ds2 = aligned.datetime_aligned(ds1, ds2)

self.__windowSize = windowSize

self.__hedgeRatio = None

self.__spread = None

self.__spreadMean = None

self.__spreadStd = None

self.__zScore = None

def getSpread(self):

return self.__spread

def getSpreadMean(self):

return self.__spreadMean

def getSpreadStd(self):

return self.__spreadStd

def getZScore(self):

return self.__zScore

def getHedgeRatio(self):

return self.__hedgeRatio

def __updateHedgeRatio(self, values1, values2):

self.__hedgeRatio = get_beta(values1, values2)

def __updateSpreadMeanAndStd(self, values1, values2):

if self.__hedgeRatio is not None:

spread = values1 - values2 * self.__hedgeRatio

self.__spreadMean = spread.mean()

self.__spreadStd = spread.std(ddof=1)

def __updateSpread(self):

if self.__hedgeRatio is not None:

self.__spread = self.__ds1[-1] - self.__hedgeRatio * self.__ds2[-1]

def __updateZScore(self):

if self.__spread is not None and self.__spreadMean is not None and self.__spreadStd is not None:

self.__zScore = (self.__spread - self.__spreadMean) / float(self.__spreadStd)

def update(self):

if len(self.__ds1) >= self.__windowSize:

values1 = np.asarray(self.__ds1[-1*self.__windowSize:])

values2 = np.asarray(self.__ds2[-1*self.__windowSize:])

self.__updateHedgeRatio(values1, values2)

self.__updateSpread()

self.__updateSpreadMeanAndStd(values1, values2)

self.__updateZScore()

class StatArb(strategy.BacktestingStrategy):

def __init__(self, feed, instrument1, instrument2, windowSize):

super(StatArb, self).__init__(feed)

self.setUseAdjustedValues(True)

self.__statArbHelper = StatArbHelper(feed[instrument1].getAdjCloseDataSeries(), feed[instrument2].getAdjCloseDataSeries(), windowSize)

self.__i1 = instrument1

self.__i2 = instrument2

# These are used only for plotting purposes.

self.__spread = dataseries.SequenceDataSeries()

self.__hedgeRatio = dataseries.SequenceDataSeries()

def getSpreadDS(self):

return self.__spread

def getHedgeRatioDS(self):

return self.__hedgeRatio

def __getOrderSize(self, bars, hedgeRatio):

cash = self.getBroker().getCash(False)

price1 = bars[self.__i1].getAdjClose()

price2 = bars[self.__i2].getAdjClose()

size1 = int(cash / (price1 + hedgeRatio * price2))

size2 = int(size1 * hedgeRatio)

return (size1, size2)

def buySpread(self, bars, hedgeRatio):

amount1, amount2 = self.__getOrderSize(bars, hedgeRatio)

self.marketOrder(self.__i1, amount1)

self.marketOrder(self.__i2, amount2 * -1)

def sellSpread(self, bars, hedgeRatio):

amount1, amount2 = self.__getOrderSize(bars, hedgeRatio)

self.marketOrder(self.__i1, amount1 * -1)

self.marketOrder(self.__i2, amount2)

def reducePosition(self, instrument):

currentPos = self.getBroker().getShares(instrument)

if currentPos > 0:

self.marketOrder(instrument, currentPos * -1)

elif currentPos < 0:

self.marketOrder(instrument, currentPos * -1)

def onBars(self, bars):

self.__statArbHelper.update()

# These is used only for plotting purposes.

self.__spread.appendWithDateTime(bars.getDateTime(), self.__statArbHelper.getSpread())

self.__hedgeRatio.appendWithDateTime(bars.getDateTime(), self.__statArbHelper.getHedgeRatio())

if bars.getBar(self.__i1) and bars.getBar(self.__i2):

hedgeRatio = self.__statArbHelper.getHedgeRatio()

zScore = self.__statArbHelper.getZScore()

if zScore is not None:

currentPos = abs(self.getBroker().getShares(self.__i1)) + abs(self.getBroker().getShares(self.__i2))

if abs(zScore) <= 1 and currentPos != 0:

self.reducePosition(self.__i1)

self.reducePosition(self.__i2)

elif zScore <= -2 and currentPos == 0: # Buy spread when its value drops below 2 standard deviations.

self.buySpread(bars, hedgeRatio)

elif zScore >= 2 and currentPos == 0: # Short spread when its value rises above 2 standard deviations.

self.sellSpread(bars, hedgeRatio)

def main(plot):

instruments = ["gld", "gdx"]

windowSize = 50

# Download the bars.

feed = yahoofinance.build_feed(instruments, 2006, 2012, ".")

strat = StatArb(feed, instruments[0], instruments[1], windowSize)

sharpeRatioAnalyzer = sharpe.SharpeRatio()

strat.attachAnalyzer(sharpeRatioAnalyzer)

if plot:

plt = plotter.StrategyPlotter(strat, False, False, True)

plt.getOrCreateSubplot("hedge").addDataSeries("Hedge Ratio", strat.getHedgeRatioDS())

plt.getOrCreateSubplot("spread").addDataSeries("Spread", strat.getSpreadDS())

strat.run()

print "Sharpe ratio: %.2f" % sharpeRatioAnalyzer.getSharpeRatio(0.05)

if plot:

plt.plot()

if __name__ == "__main__":

main(True)

this is what the output should look like:

2013-09-21 00:02:35,136 yahoofinance [INFO] Creating data directory

2013-09-21 00:02:35,136 yahoofinance [INFO] Downloading gld 2006 to data/gld-2006-yahoofinance.csv

2013-09-21 00:02:35,899 yahoofinance [INFO] Downloading gdx 2006 to data/gdx-2006-yahoofinance.csv

2013-09-21 00:02:36,637 yahoofinance [INFO] Downloading gld 2007 to data/gld-2007-yahoofinance.csv

2013-09-21 00:02:37,265 yahoofinance [INFO] Downloading gdx 2007 to data/gdx-2007-yahoofinance.csv

2013-09-21 00:02:37,881 yahoofinance [INFO] Downloading gld 2008 to data/gld-2008-yahoofinance.csv

2013-09-21 00:02:38,462 yahoofinance [INFO] Downloading gdx 2008 to data/gdx-2008-yahoofinance.csv

2013-09-21 00:02:39,243 yahoofinance [INFO] Downloading gld 2009 to data/gld-2009-yahoofinance.csv

2013-09-21 00:02:39,996 yahoofinance [INFO] Downloading gdx 2009 to data/gdx-2009-yahoofinance.csv

2013-09-21 00:02:40,577 yahoofinance [INFO] Downloading gld 2010 to data/gld-2010-yahoofinance.csv

2013-09-21 00:02:42,630 yahoofinance [INFO] Downloading gdx 2010 to data/gdx-2010-yahoofinance.csv

2013-09-21 00:02:43,397 yahoofinance [INFO] Downloading gld 2011 to data/gld-2011-yahoofinance.csv

2013-09-21 00:02:44,153 yahoofinance [INFO] Downloading gdx 2011 to data/gdx-2011-yahoofinance.csv

2013-09-21 00:02:44,901 yahoofinance [INFO] Downloading gld 2012 to data/gld-2012-yahoofinance.csv

2013-09-21 00:02:45,965 yahoofinance [INFO] Downloading gdx 2012 to data/gdx-2012-yahoofinance.csv

Sharpe ratio: -0.20

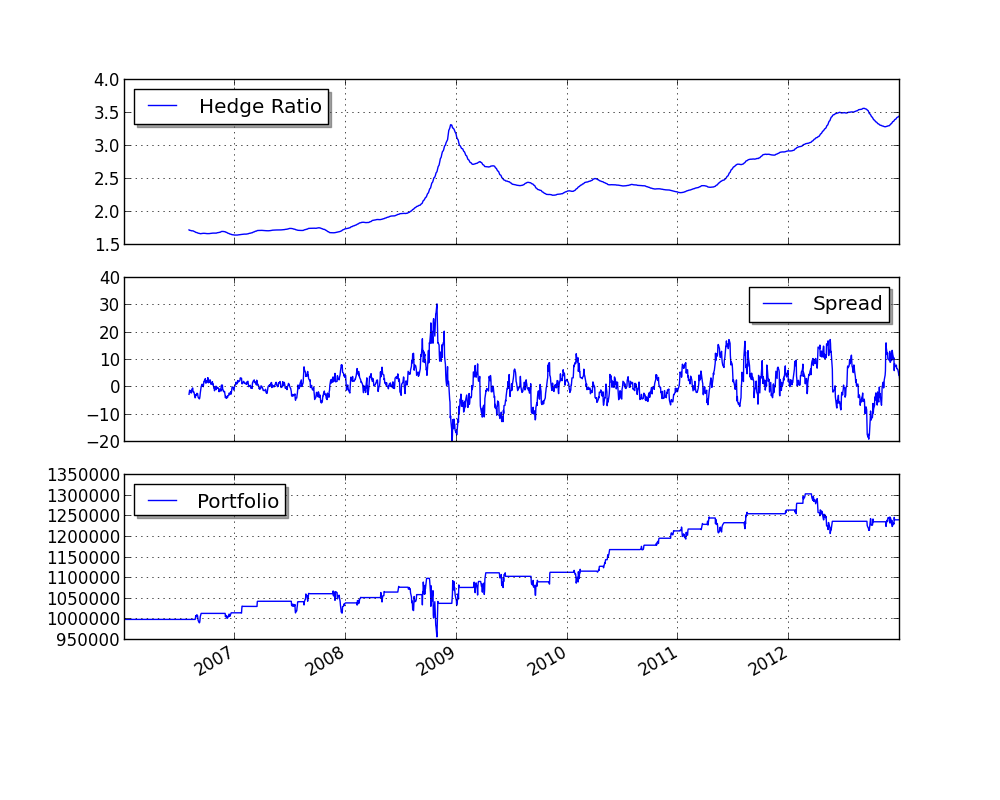

and this is what the plot should look like:

You can get better returns by tunning the window size as well as the entry and exit values for the z-score.