Market Timing Using Moving-Average Crossovers¶

- This example is inspired on the Market Timing / GTAA model described in:

The stragegy supports analyzing more than one instrument per asset class, and selects the one that has highest returns in the last month.

from __future__ import print_function

from pyalgotrade import strategy

from pyalgotrade import plotter

from pyalgotrade.barfeed import yahoofeed

from pyalgotrade.technical import ma

from pyalgotrade.technical import cumret

from pyalgotrade.stratanalyzer import sharpe

from pyalgotrade.stratanalyzer import returns

class MarketTiming(strategy.BacktestingStrategy):

def __init__(self, feed, instrumentsByClass, initialCash):

super(MarketTiming, self).__init__(feed, initialCash)

self.setUseAdjustedValues(True)

self.__instrumentsByClass = instrumentsByClass

self.__rebalanceMonth = None

self.__sharesToBuy = {}

# Initialize indicators for each instrument.

self.__sma = {}

for assetClass in instrumentsByClass:

for instrument in instrumentsByClass[assetClass]:

priceDS = feed[instrument].getPriceDataSeries()

self.__sma[instrument] = ma.SMA(priceDS, 200)

def _shouldRebalance(self, dateTime):

return dateTime.month != self.__rebalanceMonth

def _getRank(self, instrument):

# If the price is below the SMA, then this instrument doesn't rank at

# all.

smas = self.__sma[instrument]

price = self.getLastPrice(instrument)

if len(smas) == 0 or smas[-1] is None or price < smas[-1]:

return None

# Rank based on 20 day returns.

ret = None

lookBack = 20

priceDS = self.getFeed()[instrument].getPriceDataSeries()

if len(priceDS) >= lookBack and smas[-1] is not None and smas[-1*lookBack] is not None:

ret = (priceDS[-1] - priceDS[-1*lookBack]) / float(priceDS[-1*lookBack])

return ret

def _getTopByClass(self, assetClass):

# Find the instrument with the highest rank.

ret = None

highestRank = None

for instrument in self.__instrumentsByClass[assetClass]:

rank = self._getRank(instrument)

if rank is not None and (highestRank is None or rank > highestRank):

highestRank = rank

ret = instrument

return ret

def _getTop(self):

ret = {}

for assetClass in self.__instrumentsByClass:

ret[assetClass] = self._getTopByClass(assetClass)

return ret

def _placePendingOrders(self):

# Use less chash just in case price changes too much.

remainingCash = round(self.getBroker().getCash() * 0.9, 2)

for instrument in self.__sharesToBuy:

orderSize = self.__sharesToBuy[instrument]

if orderSize > 0:

# Adjust the order size based on available cash.

lastPrice = self.getLastPrice(instrument)

cost = orderSize * lastPrice

while cost > remainingCash and orderSize > 0:

orderSize -= 1

cost = orderSize * lastPrice

if orderSize > 0:

remainingCash -= cost

assert(remainingCash >= 0)

if orderSize != 0:

self.info("Placing market order for %d %s shares" % (orderSize, instrument))

self.marketOrder(instrument, orderSize, goodTillCanceled=True)

self.__sharesToBuy[instrument] -= orderSize

def _logPosSize(self):

totalEquity = self.getBroker().getEquity()

positions = self.getBroker().getPositions()

for instrument in self.getBroker().getPositions():

posSize = positions[instrument] * self.getLastPrice(instrument) / totalEquity * 100

self.info("%s - %0.2f %%" % (instrument, posSize))

def _rebalance(self):

self.info("Rebalancing")

# Cancel all active/pending orders.

for order in self.getBroker().getActiveOrders():

self.getBroker().cancelOrder(order)

cashPerAssetClass = round(self.getBroker().getEquity() / float(len(self.__instrumentsByClass)), 2)

self.__sharesToBuy = {}

# Calculate which positions should be open during the next period.

topByClass = self._getTop()

for assetClass in topByClass:

instrument = topByClass[assetClass]

self.info("Best for class %s: %s" % (assetClass, instrument))

if instrument is not None:

lastPrice = self.getLastPrice(instrument)

cashForInstrument = round(cashPerAssetClass - self.getBroker().getShares(instrument) * lastPrice, 2)

# This may yield a negative value and we have to reduce this

# position.

self.__sharesToBuy[instrument] = int(cashForInstrument / lastPrice)

# Calculate which positions should be closed.

for instrument in self.getBroker().getPositions():

if instrument not in topByClass.values():

currentShares = self.getBroker().getShares(instrument)

assert(instrument not in self.__sharesToBuy)

self.__sharesToBuy[instrument] = currentShares * -1

def getSMA(self, instrument):

return self.__sma[instrument]

def onBars(self, bars):

currentDateTime = bars.getDateTime()

if self._shouldRebalance(currentDateTime):

self.__rebalanceMonth = currentDateTime.month

self._rebalance()

self._placePendingOrders()

def main(plot):

initialCash = 10000

instrumentsByClass = {

"US Stocks": ["VTI"],

"Foreign Stocks": ["VEU"],

"US 10 Year Government Bonds": ["IEF"],

"Real Estate": ["VNQ"],

"Commodities": ["DBC"],

}

# Load the bars. These files were manually downloaded from Yahoo Finance.

feed = yahoofeed.Feed()

instruments = ["SPY"]

for assetClass in instrumentsByClass:

instruments.extend(instrumentsByClass[assetClass])

for year in range(2007, 2013+1):

for instrument in instruments:

fileName = "%s-%d-yahoofinance.csv" % (instrument, year)

print("Loading bars from %s" % fileName)

feed.addBarsFromCSV(instrument, fileName)

# Build the strategy and attach some metrics.

strat = MarketTiming(feed, instrumentsByClass, initialCash)

sharpeRatioAnalyzer = sharpe.SharpeRatio()

strat.attachAnalyzer(sharpeRatioAnalyzer)

returnsAnalyzer = returns.Returns()

strat.attachAnalyzer(returnsAnalyzer)

if plot:

plt = plotter.StrategyPlotter(strat, False, False, True)

plt.getOrCreateSubplot("cash").addCallback("Cash", lambda x: strat.getBroker().getCash())

# Plot strategy vs. SPY cumulative returns.

plt.getOrCreateSubplot("returns").addDataSeries("SPY", cumret.CumulativeReturn(feed["SPY"].getPriceDataSeries()))

plt.getOrCreateSubplot("returns").addDataSeries("Strategy", returnsAnalyzer.getCumulativeReturns())

strat.run()

print("Sharpe ratio: %.2f" % sharpeRatioAnalyzer.getSharpeRatio(0.05))

print("Returns: %.2f %%" % (returnsAnalyzer.getCumulativeReturns()[-1] * 100))

if plot:

plt.plot()

if __name__ == "__main__":

main(True)

This is what the output should look like:

Loading bars from SPY-2007-yahoofinance.csv

Loading bars from VTI-2007-yahoofinance.csv

Loading bars from DBC-2007-yahoofinance.csv

Loading bars from IEF-2007-yahoofinance.csv

Loading bars from VEU-2007-yahoofinance.csv

Loading bars from VNQ-2007-yahoofinance.csv

Loading bars from SPY-2008-yahoofinance.csv

Loading bars from VTI-2008-yahoofinance.csv

Loading bars from DBC-2008-yahoofinance.csv

Loading bars from IEF-2008-yahoofinance.csv

.

.

.

2013-10-01 00:00:00 strategy [INFO] Best for class US Stocks: VTI

2013-10-01 00:00:00 strategy [INFO] Best for class Commodities: None

2013-10-01 00:00:00 strategy [INFO] Best for class US 10 Year Government Bonds: None

2013-10-01 00:00:00 strategy [INFO] Best for class Foreign Stocks: VEU

2013-10-01 00:00:00 strategy [INFO] Best for class Real Estate: None

2013-10-01 00:00:00 strategy [INFO] Placing market order for -2 VEU shares

2013-11-01 00:00:00 strategy [INFO] Rebalancing

2013-11-01 00:00:00 strategy [INFO] Best for class US Stocks: VTI

2013-11-01 00:00:00 strategy [INFO] Best for class Commodities: None

2013-11-01 00:00:00 strategy [INFO] Best for class US 10 Year Government Bonds: None

2013-11-01 00:00:00 strategy [INFO] Best for class Foreign Stocks: VEU

2013-11-01 00:00:00 strategy [INFO] Best for class Real Estate: VNQ

2013-11-01 00:00:00 strategy [INFO] Placing market order for -1 VTI shares

2013-11-01 00:00:00 strategy [INFO] Placing market order for -1 VEU shares

2013-11-01 00:00:00 strategy [INFO] Placing market order for 39 VNQ shares

2013-12-02 00:00:00 strategy [INFO] Rebalancing

2013-12-02 00:00:00 strategy [INFO] Best for class US Stocks: VTI

2013-12-02 00:00:00 strategy [INFO] Best for class Commodities: None

2013-12-02 00:00:00 strategy [INFO] Best for class US 10 Year Government Bonds: None

2013-12-02 00:00:00 strategy [INFO] Best for class Foreign Stocks: VEU

2013-12-02 00:00:00 strategy [INFO] Best for class Real Estate: None

2013-12-02 00:00:00 strategy [INFO] Placing market order for -1 VTI shares

2013-12-02 00:00:00 strategy [INFO] Placing market order for -39 VNQ shares

Sharpe ratio: -0.06

Returns: 32.97 %

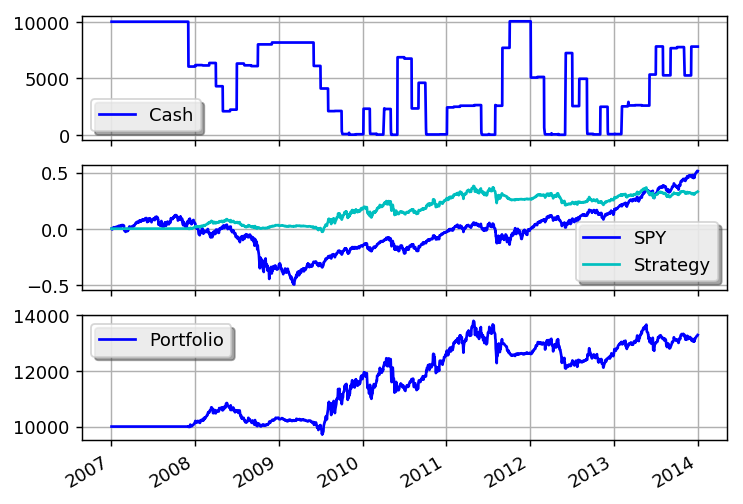

This is what the plot should look like: