VWAP Momentum Trade¶

This example is based on Momentum Trade

from __future__ import print_function

from pyalgotrade import strategy

from pyalgotrade import plotter

from pyalgotrade.tools import quandl

from pyalgotrade.technical import vwap

from pyalgotrade.stratanalyzer import sharpe

class VWAPMomentum(strategy.BacktestingStrategy):

def __init__(self, feed, instrument, vwapWindowSize, threshold):

super(VWAPMomentum, self).__init__(feed)

self.__instrument = instrument

self.__vwap = vwap.VWAP(feed[instrument], vwapWindowSize)

self.__threshold = threshold

def getVWAP(self):

return self.__vwap

def onBars(self, bars):

vwap = self.__vwap[-1]

if vwap is None:

return

shares = self.getBroker().getShares(self.__instrument)

price = bars[self.__instrument].getClose()

notional = shares * price

if price > vwap * (1 + self.__threshold) and notional < 1000000:

self.marketOrder(self.__instrument, 100)

elif price < vwap * (1 - self.__threshold) and notional > 0:

self.marketOrder(self.__instrument, -100)

def main(plot):

instrument = "AAPL"

vwapWindowSize = 5

threshold = 0.01

# Download the bars.

feed = quandl.build_feed("WIKI", [instrument], 2011, 2012, ".")

strat = VWAPMomentum(feed, instrument, vwapWindowSize, threshold)

sharpeRatioAnalyzer = sharpe.SharpeRatio()

strat.attachAnalyzer(sharpeRatioAnalyzer)

if plot:

plt = plotter.StrategyPlotter(strat, True, False, True)

plt.getInstrumentSubplot(instrument).addDataSeries("vwap", strat.getVWAP())

strat.run()

print("Sharpe ratio: %.2f" % sharpeRatioAnalyzer.getSharpeRatio(0.05))

if plot:

plt.plot()

if __name__ == "__main__":

main(True)

this is what the output should look like:

2017-07-24 22:43:34,182 quandl [INFO] Downloading AAPL 2011 to ./WIKI-AAPL-2011-quandl.csv

2017-07-24 22:43:36,415 quandl [INFO] Downloading AAPL 2012 to ./WIKI-AAPL-2012-quandl.csv

Sharpe ratio: 0.89

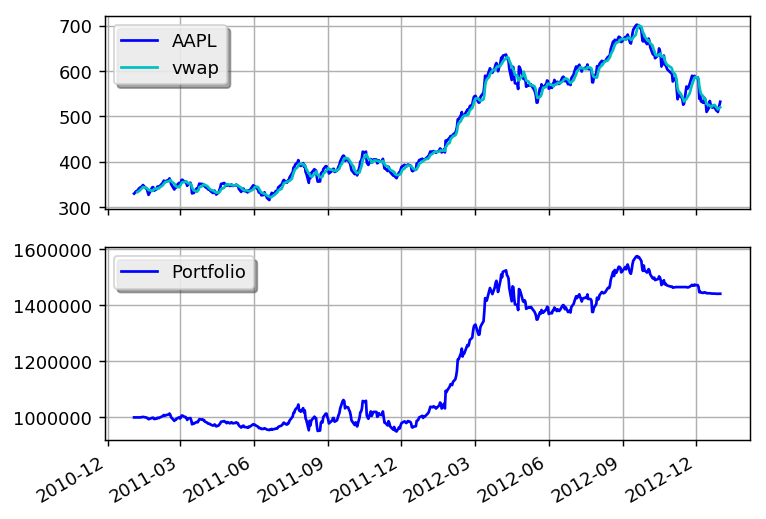

and this is what the plot should look like:

You can get better returns by tunning the VWAP and threshold parameters.