Quandl integration¶

The purpose of this example is to show how to integrate any time-series data in CSV format into a strategy.

We’ll use the following CSV data from Quandl: http://www.quandl.com/OFDP-Open-Financial-Data-Project/GOLD_2-LBMA-Gold-Price-London-Fixings-P-M

from pyalgotrade import strategy

from pyalgotrade import plotter

from pyalgotrade.tools import yahoofinance

from pyalgotrade.feed import csvfeed

import datetime

class MyStrategy(strategy.BacktestingStrategy):

def __init__(self, feed, quandlFeed, instrument):

strategy.BacktestingStrategy.__init__(self, feed)

self.setUseAdjustedValues(True)

self.__instrument = instrument

# It is VERY important to add the the extra feed to the event dispatch loop before

# running the strategy.

self.getDispatcher().addSubject(quandlFeed)

# Subscribe to events from the Quandl feed.

quandlFeed.getNewValuesEvent().subscribe(self.onQuandlData)

def onQuandlData(self, dateTime, values):

self.info(values)

def onBars(self, bars):

self.info(bars[self.__instrument].getAdjClose())

def main(plot):

instruments = ["gld"]

# Download the bars.

feed = yahoofinance.build_feed(instruments, 2006, 2012, ".")

# Load Quandl CSV downloaded from http://www.quandl.com/OFDP-Open-Financial-Data-Project/GOLD_2-LBMA-Gold-Price-London-Fixings-P-M

quandlFeed = csvfeed.Feed("Date", "%Y-%m-%d")

quandlFeed.setDateRange(datetime.datetime(2006, 1, 1), datetime.datetime(2012, 12, 31))

quandlFeed.addValuesFromCSV("quandl_gold_2.csv")

myStrategy = MyStrategy(feed, quandlFeed, instruments[0])

if plot:

plt = plotter.StrategyPlotter(myStrategy, True, False, False)

plt.getOrCreateSubplot("quandl").addDataSeries("USD", quandlFeed["USD"])

plt.getOrCreateSubplot("quandl").addDataSeries("EUR", quandlFeed["EUR"])

plt.getOrCreateSubplot("quandl").addDataSeries("GBP", quandlFeed["GBP"])

myStrategy.run()

if plot:

plt.plot()

if __name__ == "__main__":

main(True)

this is what the output should look like:

2006-01-01 00:00:00 strategy [INFO] {'USD': 513.0, 'GBP': 298.204, 'EUR': 433.533}

2006-01-03 00:00:00 strategy [INFO] 53.12

2006-01-04 00:00:00 strategy [INFO] 53.3

2006-01-05 00:00:00 strategy [INFO] 52.34

2006-01-06 00:00:00 strategy [INFO] 53.72

2006-01-08 00:00:00 strategy [INFO] {'USD': 535.25, 'GBP': 302.572, 'EUR': 440.173}

2006-01-09 00:00:00 strategy [INFO] 54.6

2006-01-10 00:00:00 strategy [INFO] 54.06

2006-01-11 00:00:00 strategy [INFO] 54.53

2006-01-12 00:00:00 strategy [INFO] 54.43

.

.

.

2012-12-19 00:00:00 strategy [INFO] 161.69

2012-12-20 00:00:00 strategy [INFO] 159.73

2012-12-21 00:00:00 strategy [INFO] 160.33

2012-12-23 00:00:00 strategy [INFO] {'USD': 1651.5, 'GBP': 1019.256, 'EUR': 1253.701}

2012-12-24 00:00:00 strategy [INFO] 160.62

2012-12-26 00:00:00 strategy [INFO] 160.78

2012-12-27 00:00:00 strategy [INFO] 161.16

2012-12-28 00:00:00 strategy [INFO] 160.54

2012-12-30 00:00:00 strategy [INFO] {'USD': 1657.5, 'GBP': 1027.206, 'EUR': 1253.024}

2012-12-31 00:00:00 strategy [INFO] 162.02

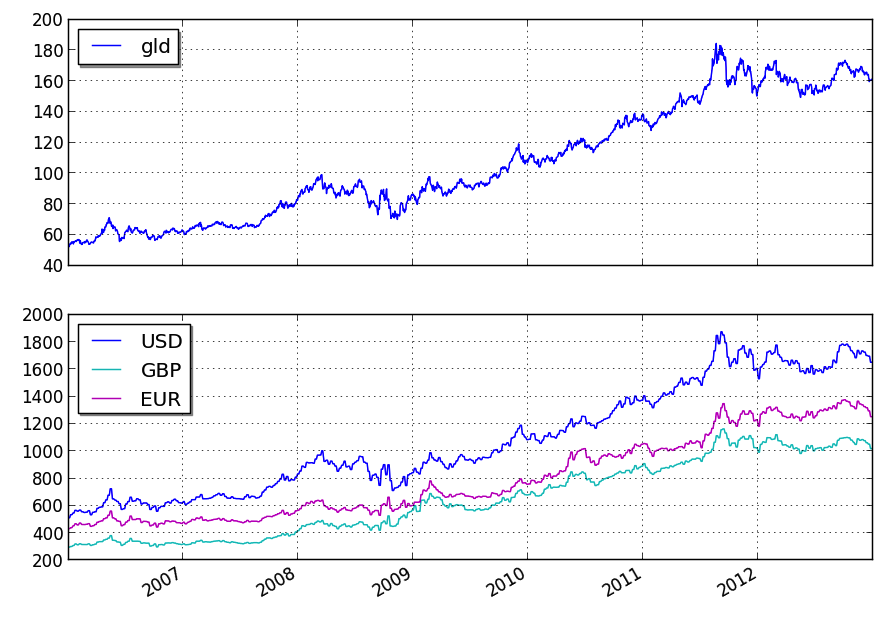

and this is what the plot should look like:

you can get better returns by tunning the Bollinger Bands period as well as the entry and exit points.